No Faulty Workmanship in Court of Appeal’s Interpretation of Common Exclusion Clause

The Alberta Court of Appeal recently addressed a recurring coverage issue: the conflict between the broad protection intended by an “all perils” property insurance policy and an exclusion for the costs of making good faulty workmanship. Based in part on the general purpose of such insurance, the decision in Condo Corp No 9312374 v Aviva Insurance Co of Canada held that property damage directly caused by the faulty workmanship of a contractor was covered, as long as it was outside the scope of work for which the contractor was hired.

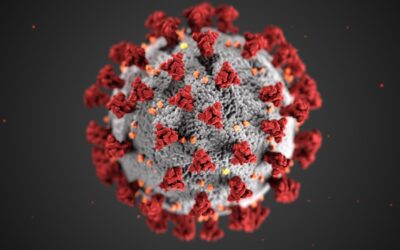

Insurance for Business Interruption resulting from the COVID-19 pandemic: What your policy may cover

On March 23, 2020, the Ontario government announced that to fight the spread of COVID-19, effective March 24th at 11:59 pm, all businesses not deemed “essential” by the government would have to close their physical workplaces.[1] A little over a week later, the list of “essential” businesses was significantly restricted. Some businesses, such as certain retail establishments, remain “essential” but have been ordered to restrict their operations, such as by only allowing customer pickup of goods outside the store.[2] Non-essential businesses can only operate remotely, which for many means they operate at a reduced capacity, if at all.

This article provides basic information on business interruption insurance (BII), which is a common type of commercial property insurance. For many insureds, BII is the coverage most likely to respond to losses resulting from restrictions imposed to fight COVID-19.

Covered for Professional Fees: Let the Church Say Amen!

Some policyholders purchase professional fees coverage as an extension to their insurance policy’s general coverage grant. Professional fees coverage is meant to reimburse an insured for the expense of hiring professionals to assist in quantifying a loss and putting a claim together to satisfy an insurer’s requirements. Ontario’s Superior Court of Justice recently released a decision addressing who controls the decision of whether such professionals will be retained and have their fees covered by the insurance policy.

Good faith obligations survive bankruptcy of the insured

An insurer’s duty of good faith is not extinguished upon the bankruptcy of the insured, the Ontario Superior Court of Justice recently confirmed in Re McEwen (2019 ONSC 5593).

Speak Now or Forever Hold Your Peace: Ontario Court of Appeal rejects Insurer’s attempt to withdraw defence

The Court of Appeal for Ontario recently held that an insurer which defended its insured for ten months, without a reservation of rights, could not rely on a policy exclusion to withdraw its defence. The litigation was at the discovery stage, although examinations had not been held, when the insurer tried to withdraw coverage. The court said, “too bad, too sad” (in other words) and held that the insurer was estopped from withdrawing coverage.

Ontario Court of Appeal: Insured’s Failure to Provide Up to Date Address Not a “Breach of Duty to Cooperate” as not “Substantial”

In Ruddell v. Gore Mutual Insurance Company,1 an insurer argued that its insured’s failure to keep them updated on her current address was a substantial breach of the duty to cooperate. On a summary judgment motion, a judge of the Ontario Superior Court disagreed and ruled that – in these circumstances – the insured’s conduct was not a “substantial” failure to cooperate. This was upheld on appeal.

A coverage ‘Thrilla’ in Manila – Court finds underinsured endorsement provides worldwide coverage

A recent decision of the Alberta Court of Queen’s Bench demonstrates that policy holders must carefully consider the interplay between an insurance policy and its endorsements. In Wage v Canadian Direct Insurance Incorporated, 2019 ABQB 303, the court interpreted a standard form family protection endorsement to an automobile insurance policy to provide coverage for an accident in the Philippines, even though the territorial limit of the underlying policy was Canada and the United States.

Speeding Motor Vehicle Makes an Eggs-press Delivery

An Ontario court recently found that the injuries sustained by a pedestrian when eggs were thrown at her from a vehicle arose “directly or indirectly from the use or operation of an automobile”. The court determined that the act of egg throwing in this case was not a distinct and intervening act from the use or operation of the vehicle, as the speeding vehicle created speed and kinetic energy for the egg(s) which were crucial in causing the extensive damage it did.

Traders v. Gibson: Injury claim between co-habiting family covered by homeowner’s policy despite “household exclusion”

An Ontario court recently found that a personal injury claim, by a daughter against her mother, was covered by homeowner’s insurance. The two lived together and the policy contained an exclusion for claims arising from injury to “any person residing in [the] household”. However, the court concluded that the daughter was a “tenant” under the policy and therefore the exclusion did not apply. In the absence of explicit terms, the court concluded that the insured had a reasonable expectation of coverage for claims made by tenants, even if that tenant was a family member.

Ontario Court rejects well established rules for interpreting insurance policy exclusions

In Pembridge Insurance Company of Canada v Chu, a judge of Ontario’s Superior Court of Justice recently concluded that insurance policies ought to be interpreted differently when multiple insurers are involved. In this problematic decision, the court deviated from the long-standing rule that exclusion clauses should be interpreted “narrowly”. Remarkably, the court began with the assumption that one of the insurance policies must respond to the loss. Based on this assumption, the court decided that different rules of contractual interpretation would apply.

This case is problematic because (i) it conflicts with the well-established rules for policy interpretation; (ii) it suggests that a policy can be interpreted by looking outside the contract to its effect on a non-party; and (iii) the assumption that one policy must indemnify the insured was both irrelevant and an improper consideration on a duty to defend application. Absent appellate guidance, this decision may create confusion and unintended consequences on coverage applications involving multiple insurers.