Concurrent Duty to Defend – A Team Sport

In Markham (City) v. AIG Insurance Company of Canada, 2020 ONCA 239, the Ontario Court of Appeal addressed three important elements of the duty to defend, where there is concurrent coverage under two policies: whether there was a concurrent duty to defend given the existence of an “other insurance” clause, the obligation to pay ongoing costs and its allocation, and the right to participate in the defence.

That’s Cold: Insurer Ordered to Defend Claims Made Against Cold Storage Provider

In Intact v. Clauson, The Alberta Court of Appeal ordered an insurer to defend claims made against the insured’s cold storage business, which was sued when its warehouse thawed and damaged its customer’s food products. This decision is consistent with leading principles of insurance law, which emphasize the importance of reading the contract as a whole when interpreting the meaning of a particular provision, and underlines that it is important to always review the specific words of a policy to determine coverage, not rely on received wisdom about what a policy typically covers.

Policyholder’s Entitlement to Interest No Less than Other Litigants

In Watt v TD Insurance, the Superior Court of Justice confirmed that interest is payable on judgments against insurers, even where the damages awarded are only to compensate for the loss of chattels. The decision followed an earlier Court of Appeal case that held an insured was entitled to interest notwithstanding that policy limits had already been reached. Together, the two decisions underline that insurance considerations do not negate a policyholder’s entitlement to interest payable under ordinary litigation principles. The implications of the decision are welcomed in all disputes with insurers that fail to indemnify policyholders in a timely manner.

No Faulty Workmanship in Court of Appeal’s Interpretation of Common Exclusion Clause

The Alberta Court of Appeal recently addressed a recurring coverage issue: the conflict between the broad protection intended by an “all perils” property insurance policy and an exclusion for the costs of making good faulty workmanship. Based in part on the general purpose of such insurance, the decision in Condo Corp No 9312374 v Aviva Insurance Co of Canada held that property damage directly caused by the faulty workmanship of a contractor was covered, as long as it was outside the scope of work for which the contractor was hired.

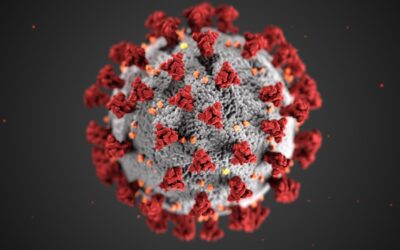

Insurance for Business Interruption resulting from the COVID-19 pandemic: What your policy may cover

On March 23, 2020, the Ontario government announced that to fight the spread of COVID-19, effective March 24th at 11:59 pm, all businesses not deemed “essential” by the government would have to close their physical workplaces.[1] A little over a week later, the list of “essential” businesses was significantly restricted. Some businesses, such as certain retail establishments, remain “essential” but have been ordered to restrict their operations, such as by only allowing customer pickup of goods outside the store.[2] Non-essential businesses can only operate remotely, which for many means they operate at a reduced capacity, if at all.

This article provides basic information on business interruption insurance (BII), which is a common type of commercial property insurance. For many insureds, BII is the coverage most likely to respond to losses resulting from restrictions imposed to fight COVID-19.

Covered for Professional Fees: Let the Church Say Amen!

Some policyholders purchase professional fees coverage as an extension to their insurance policy’s general coverage grant. Professional fees coverage is meant to reimburse an insured for the expense of hiring professionals to assist in quantifying a loss and putting a claim together to satisfy an insurer’s requirements. Ontario’s Superior Court of Justice recently released a decision addressing who controls the decision of whether such professionals will be retained and have their fees covered by the insurance policy.

Good faith obligations survive bankruptcy of the insured

An insurer’s duty of good faith is not extinguished upon the bankruptcy of the insured, the Ontario Superior Court of Justice recently confirmed in Re McEwen (2019 ONSC 5593).

Speak Now or Forever Hold Your Peace: Ontario Court of Appeal rejects Insurer’s attempt to withdraw defence

The Court of Appeal for Ontario recently held that an insurer which defended its insured for ten months, without a reservation of rights, could not rely on a policy exclusion to withdraw its defence. The litigation was at the discovery stage, although examinations had not been held, when the insurer tried to withdraw coverage. The court said, “too bad, too sad” (in other words) and held that the insurer was estopped from withdrawing coverage.

Supreme Court of Canada: Substance-over-Form Dictates Whether Discoverability Applies to Statutory Limitations

There are many statutes containing limitation periods that bar plaintiffs from bringing an action after a specified period of time. Provincial limitation acts have largely codified the “discoverability principle” (i.e. that a cause of action does not arise until it is discovered by the person who suffered the injury alleged) for many general limitation periods. However, other statutes are silent or ambiguous on whether discoverability applies. Whether dealing in real property, insurance, competition, or otherwise, the wording of these limitations vary in scope and when the stated period starts to run.

The Supreme Court of Canada has recently brought clarity to this issue. In its recent decision in Pioneer v. Godfrey, 2019 SCC 42, the Court held that wherever a limitation period is triggered by the accrual of a cause of action, the discoverability rule will apply unless the legislation explicitly states otherwise.

In ODD decision, Supreme Court severs link between certification and common issues trial for price-fixing cases

The Supreme Court of Canada’s decision in Pioneer Corporation v Godfrey, 2019 SCC 42, was a victory for the plaintiff, but it may prove advantageous for class action defendants in other cases. In an 8 to 1 decision released on September 20, 2019, the court accepted a lowered standard for certification of price-fixing claims. But it disconnected that standard from required elements for success at trial, and affirmed a higher standard at the liability stage than other recent case law suggested.